Course

Welcome to Our GST Course

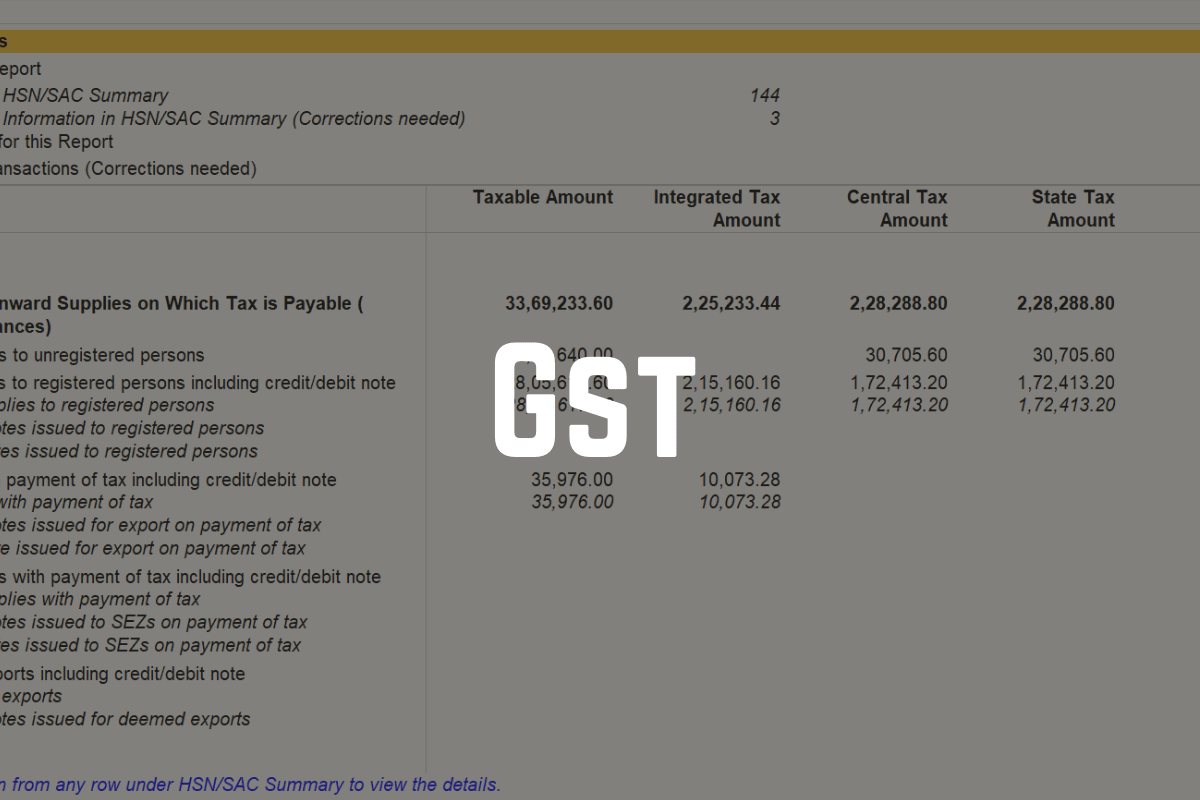

Welcome to Oxford Institute If you want to understand the Goods and Services Tax (GST) and its impact on businesses and the economy, you’ve come to the right place. GST is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. It was introduced in India on July 1,2017, to simplify the indirect tax structure and bring uniformity across the country. GST replaced multiple indirect taxes like service tax, excise duty, and others, creating a single national market.

Our GST course is designed to provide you with a deep understanding of the GST framework, its principles, and practical applications. Whether you are a student, professional, or business owner, this course will equip you with the knowledge and skills to navigate the GST system confidently.

Why Learn GST?

- Practical Insights: Learn from real-world examples and case studies that provide practical insights into GST implementation.

- Expert Guidance: Get taught by experienced professionals who have in-depth knowledge of GST and its workings.

- Career Advancement: Enhance your career prospects by gaining expertise in GST, a crucial area of business and finance.

Course Info

Who Should Enroll?

Students: Build a strong foundation in GST to enhance your academic and professional journey.

Professionals: Upgrade your skills and stay relevant in the ever-evolving business landscape.

Business Owners: Understand the GST framework to ensure compliance and optimize your tax strategies.

Enroll Now!

Don’t miss out on this opportunity to master GST and take your knowledge to the next level. Join our GST course today and unlock new career possibilities. Click here to enroll and start your journey with Oxford Institute.

Course Highlights

Introduction Of GST

Vouchers Entry

Bill Invoice with GST

Advance Receipt

Adjustment Entry

TDS(Tax Deduction At Source)

And So On

Contact Us For All Topics